Introduction

Entrepreneurs, investors, attorneys, and anybody else wishing to confirm the validity of a company registered in the state of Texas should all conduct a Texas business entity search. The Texas Secretary of State’s business search tool offers vital information on a company’s legal situation whether your company is starting from nothing, confirming the state of an existing one, or doing due diligence on a possible business partner. Using this resource will help you verify name availability, make sure a company complies with state laws, and get important information including ownership structure and registered agent.

Key Takeaways

- The Texas business entity search helps you verify company registration, legal standing, and ownership information.

- The Texas Secretary of State website offers a free and user-friendly tool to conduct business entity searches.

- Business entity searches are crucial for entrepreneurs, investors, and legal professionals to verify a company’s legitimacy.

- Key details such as company names, filing numbers, statuses, and registered agents are included in the search.

- Entrepreneurs can check for existing business names to avoid conflicts during new business registration.

- The article covers common FAQs like how to search, the types of entities in Texas, and the effective use of results.

A Texas Business Entity Search is what?

Definitions and Synopsis

The process of obtaining public records regarding companies registered with the Texas Secretary of State is known as a Texas business entity search This inquiry offers details on:

- The current state of business registration: active or inactive.

- Details about: The founders, main players, and officials of the company define ownership.

- Registered Agent Information: The person or entity authorized to pick up legal documentation on behalf of the company.

- Details: The business’s registration date and unique identification number help one file numbers and dates.

This technology mostly serves to enable responsibility and openness for companies running in Texas.

Value of a Search for a Texas Business Entity

Why Would You Want to Search Business Entities?

Doing a Texas business entity search is crucial for several reasons.

- Check business legitimacy to be sure the company follows Texas regulations and is correctly registered.

- Entrepreneurs launching a new company should look to be sure their intended business name is not already in use.

- Get registered agent information here. For official correspondence, contact the legal representative of the company.

- Examine business ownership. Especially in mergers, acquisitions, or collaborations, know the people behind the company.

- Know the filing status. Find out if the company is legally restricted, dissolved, or operating.

- Guide for Step-by-Step Texas Business Entity Search

- These actions will help to simplify the search process:

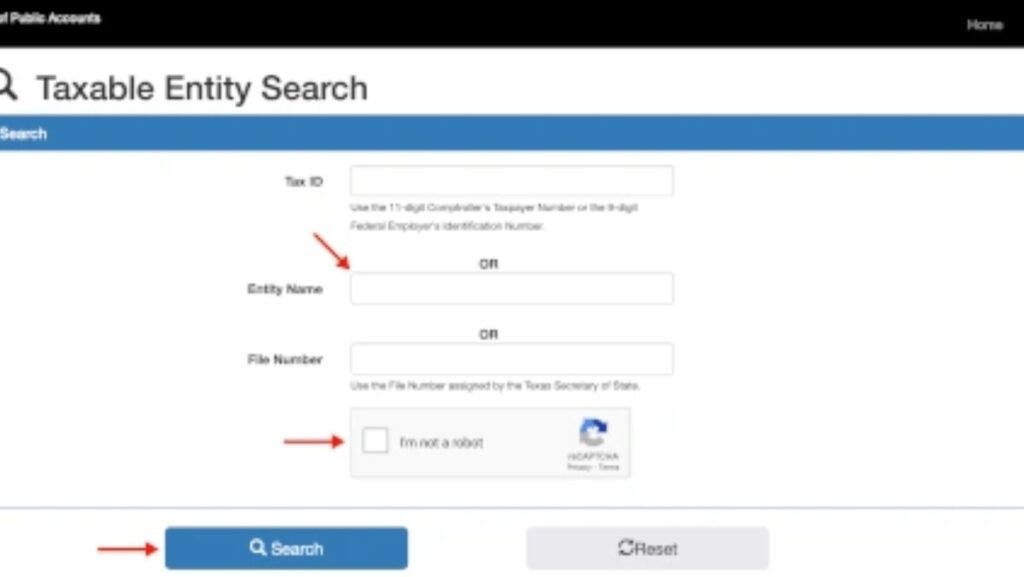

First step: visit the Texas Secretary of State website.

Look first on the official Texas Secretary of State Business Search page. There only just one recognized and approved tool available for a Texas corporate entity search:

- Second step choose the correct search type.

- From the three main search forms one can choose:

- Business Name: Perfect for confirming a corporation or looking up a checking name availability.

- File Number: This is helpful should the company assign a unique file number.

- Sometimes: Used in situations involving the Tax ID number of your company.

- Third step: input the pertinent information.

Enter the company name, tax ID, or filing number depending on the search type into the designated fields. Searching by name also permits incomplete name searches.

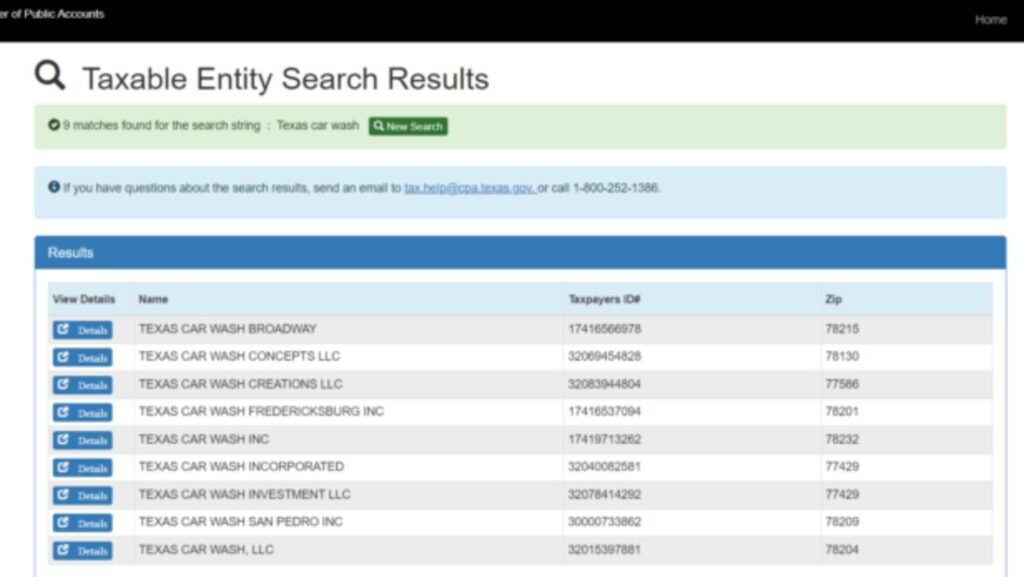

Fourth step: go over the search results.

The system will show a list of related companies depending on your search parameters. This covers important details including:

- Corporate Name: The registered official name with the state.

- Number of Filing: The particular number given to the company upon registration.

- Status: Whether or not the company is active.

- Forming Date: The date the entity came into being.

- Legal matters contact: registered agent information.

- Step Five: Get Specific Information

- Click the entity: Name to receive more specific information including:

Business Type: LLC, Corp., Partnership, etc.

- Officer or Director Details: Names and titles of those occupying important roles.

- Physical: postal address connected to the company.

- Request: official documentation in step six, if necessary.

- Should: you require official documentation—such as a certificate of good standing—the search results page lets you request and download these materials for a nominal charge.

Save or print the results in step

You can store or print the search results for future use once you acquire the necessary knowledge.

Types of Business Entities in Texas

Texas Business Entity Overview

Texas accepts various forms of business entities, each with particular legal ramifications, structures, and advantages. The most prevalent forms are:

Limited Liability Company (LLC)

Though with less paperwork, an LLC gives owners—also known as members—liability protection akin to that of a corporation. Through pass-through taxes, this business form offers tax benefits and is the most flexible.

File cost: $300 formation fee

.There is no annual report needed; instead, a Public Information Report has to be turned in.

Company

Offering liability protection to stockholders and different tax advantages, corporations are more regimented than LLCs Still, companies are subject to more rigorous state and federal rules.

- For a for-profit company, formation expenses run $300.

- Companies have to pay a franchise tax and turn in annual reports.

Typical Partnership

All of the partners in a general partnership bear equal liability for the operations and debts of the company. Though the structure is basic, it exposes partners to personal responsibility.

- Formation Cost: Although optional to register a partnership, no state filing charge.

- Generally speaking: General partnerships do not call for yearly filings until registered.

LP, or limited partnership

General partners with unlimited liability and limited partners with limited responsibility but cannot run the business make up a limited partnership.

File cost: $750 for formation.

Every year maintenance calls for annual public information reports.

Sole Proprietary Agent

With one person running and owning the company, a sole proprietorship is the simplest form of business structure. The owner is personally accountable for any obligations since the business and the owner are one in nature.

- Formation Cost: Not any official filing is needed.

- Annual Maintenance: Not need any annual filings or reports.

- Table: Texas Business Entity Comparision Frequently Asked Questions (FAQs) About Texas Business

FAQs

How can I find out whether Texas accepts a given business name?

Use the company search tool available from Texas Secretary of State to investigate name availability. Enter the suggested name; the system will show whether the name is already in use.

A Texas corporate entity search provides what information?

A Texas business entity search offers access to the entity’s file number, registered agent, business status active/inactive, officer/director names, and crucial filing dates.

Can I search for a business organization free-of charge?

Indeed, one can use the free Texas business entity search tool. Requesting official records, such a certificate of good standing, could, however, incur fees.

Questions With Entity Specificity

Which kind of commercial companies call Texas home?

Texas accepts LLCs, corporations, limited partnerships, general partnerships, and sole proprietorships as among the several company formations.

How may I obtain a certificate of good standing for a Texas company?

Perform a business entity search, find the company, and then request a certificate of good standing using the Texas Secretary of State website.

Who must have a registered agent?

Every Texas corporate entity has to choose a registered agent to handle legal paperwork on behalf of the company. The agent may be a legal body or an individual.

- In Texas Business Entities, Registered Agents: Their Function Describe a registered agent.

A registered agent is someone or company designated to accept legal documents on behalf of the company. Every business entity, including an LLC or Corporation, under Texas law must name a registered agent.

Main Agent Responsibilities

Get legal documents including summons, lawsuits, and compliance alerts.

- Forward significant paperwork: After acquired, the agent sends the records to the officials or business owner.

The agent makes sure companies satisfy legal criteria established by the state, including annual report filing.

Conclusion

Professionals, investors, and entrepreneurs would find great value in a Texas company entity search. The Texas Secretary of State’s web tool offers vital information to help with decision-making whether your verification of a company’s legitimacy, business name availability, or registered agent availability. Knowing the company forms identified in Texas— LLCs, corporations, and partnerships—helps businesses decide which direction to take. Following the detailed above step-by-step guide will help you to securely perform a business entity search, defend your interests, and guarantee Texas law compliance.