Opening an exemple business plan assurance pdf calls for more than just knowing the items you intend to sell. It calls for a strong business plan that directs your activities, draws in capital, and supports long-term viability. An example business plan for assurance (insurance) can be a great tool to arrange your ideas, plans, and objectives whether you are creating a big-scale insurance company or a small insurance agency. With an eye on what you should include to create a successful plan, this essay will dissect the core elements of an insurance company strategy. We will also go over the main factors to be taken into account in the process and offer a useful PDF sample.

Key Takeaways:

- A well-structured business plan is crucial for launching and scaling an insurance company.

- The business plan outlines key areas like market analysis, financial projections, and operational strategies.

- Using a business plan example or template for insurance can help simplify the planning process.

- A successful business plan should be clear, concise, and specific, with a focus on sustainability and growth.

- Insurance businesses often face specific challenges such as regulatory compliance and competition, which should be addressed in the plan.

- Financial projections and risk management strategies are key to attracting investors and securing funding.

- The business plan should also focus on marketing strategies, customer acquisition, and operational efficiency.

Why, for an insurance company, is a business plan very essential?

Exemple business plan assurance pdf is a basic paper outlining your company’s goals, policies, and financial projections. A business plan is even more important for an insurance company since it provides a road map to success while handling issues unique to their sector.You should have a business strategy for your insurance company primarily for the following reasons:

Luring Investors and Getting Money

To assess the possible profitability of your insurance company, banks and investors demand a thorough business plan. Clear plans displaying market prospects, financial projections, and risk management techniques will help to guarantee the money required to launch your company.

Specifying Business Goals

A company strategy clarifies well defined, reasonable objectives. This covers everything from reaching a particular income target to entering new markets and gathering a given client count.

Also Learn More: exemple business plan assurance pdf

Guaranteeing Regulatory Compliance

There is much regulation in the insurance business. Your company plan should clearly show how you intend to remain compliant with state and federal rules, therefore preventing expensive penalties or legal problems.

Formulating Operational Policies

Policies, claims, customer service, risk management—all of which an insurance company handles—need simplified procedures. A business plan facilitates the organization of various operational strategies, therefore facilitating monitoring and optimization of operations.

Positioning and Development of Markets

The business plan enables you to create a distinctive value proposition by helping you to find market gaps, rivals, and possible consumers. The expansion strategy contained in the plan enables your company to reach new markets and scale effectively.

Main Elements of an Insurance Business Plan

An insurance company’s all-encompassing business plan should include numerous important aspects. The key parts your company plan should contain are shown here.

| Section | Description |

|---|---|

| Executive Summary | A concise overview of your business plan, outlining your goals, mission, and vision. |

| Company Description | A detailed description of your company, including the legal structure, ownership, and history. |

| Market Research and Analysis | In-depth analysis of the insurance market, including competitors, market trends, and customer segmentation. |

| Marketing and Sales Strategy | A clear strategy for attracting and retaining customers, along with sales tactics and marketing channels. |

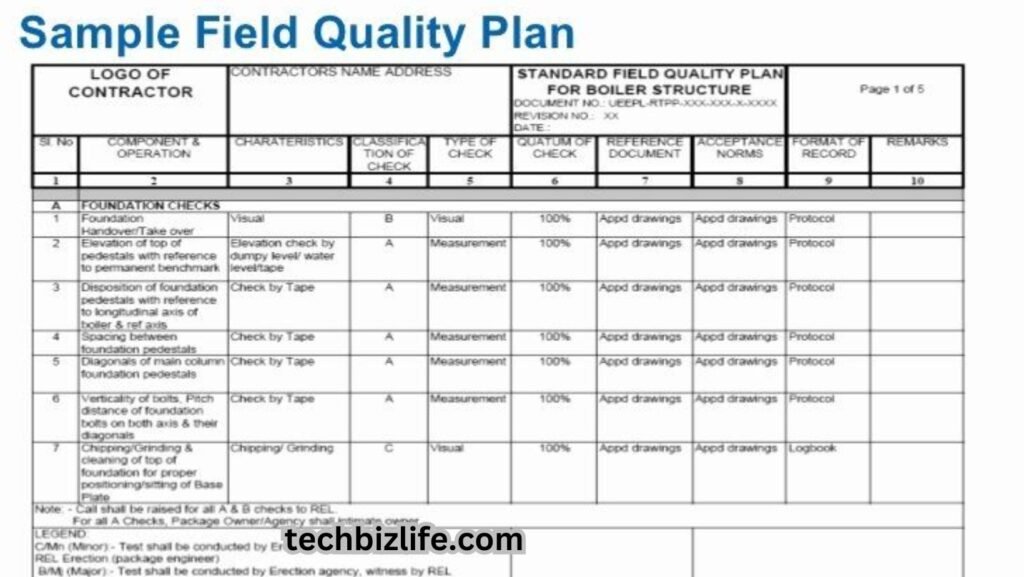

| Operations Plan | An outline of the daily operations of the insurance company, from claims handling to policy issuance. |

| Financial Plan | A detailed projection of your financial performance, including income statements, balance sheets, and cash flow. |

| Risk Management Strategy | A plan to identify, assess, and mitigate potential risks that could impact your business operations. |

Writing a business plan for an insurance company

Creating an exemple business plan assurance pdf strategy uses a methodical process. Every part of the strategy must be thorough, fact-based, and realistic regarding expansion and market prospects. Allow us to methodically dissect the process.

Executive summary

Although it comes first in your business plan, the executive summary is usually best written last. This overview need to give a quick picture of your company, stressing your goal, the insurance products you will sell, the target market, and your expected expansion. Attracting the attention of possible investors should be easy and interesting. Important ideas to incorporate within the executive summary:

- Your company’s purpose statement

- Important aims and objectives

- Presentation of your insurance products

- Financial projection summary including funding requirements

Company Description

If relevant, this part should outline the legal framework, operations of your insurance company, and background. If you are launching a new company, pay close attention to what sets yours apart from current rivals. Important elements of this part consist in:

- Company name and site

- Business structure (LLC, company, etc.).

- The insurance offerings you will present

- Information on management team and ownership

Also Learn More: exemple business plan assurance pdf

Analysis and Research of Markets

An exemple business plan assurance pdf works under rules and in a competitive atmosphere. Understanding your competition and possible clients so depends on doing extensive market research. The present trends in the market, industry rules, consumer groups, and rivals should be included in this part. Look for to compile the information:

- Insurance sector market size and prospective rates of growth

- Important consumer groups and purchasing patterns

- Analysis of competitors highlighting their advantages and shortcomings

- Legal requirements and regulatory environment

Sales Strategy and Marketing Plans

The way you want to find and keep customers will be discussed in this part. It should address your marketing channels—online, direct mail, alliances, sales strategies, and client retention techniques. Important components to be addressed:

- Digital marketing plans (SEO, content marketing, social media) and online presence

- Strategy of pricing and any special selling feature

- Target setting and sales team organization

- Customer relationships and retention techniques

Operations Plan

The operations plan offers understanding of the daily activities of your insurance company. This covers everything from customer support systems to your claims procedure to IT infrastructure to human resources. You should be exact:

- Procedures for policy distribution and claim handling

- Support framework and customer service

- Technology tools or systems applied in claims processing and insurance management.

- Staffing and human resource requirements

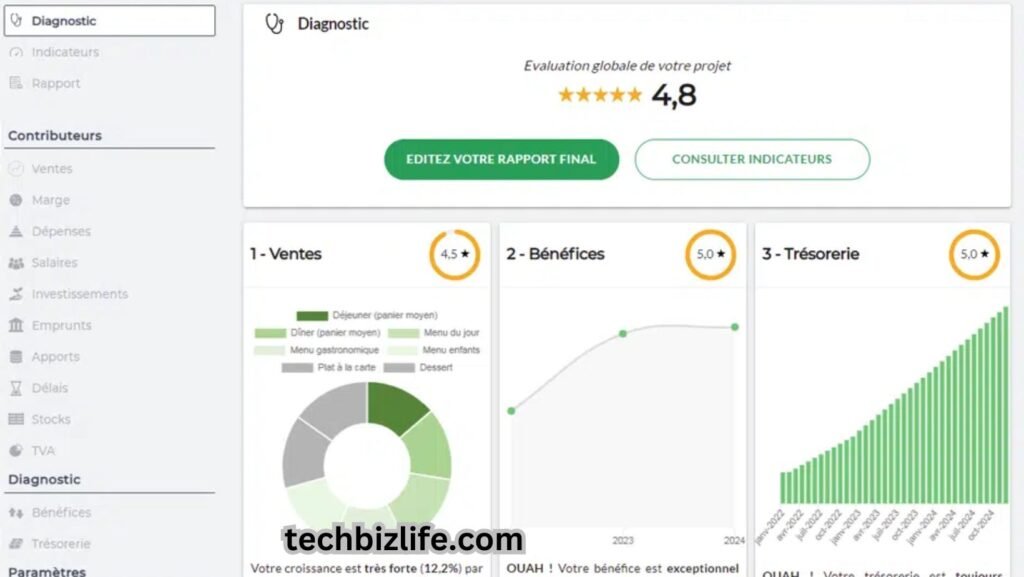

Financial Strategy

Of all the components of your company plan, the financial one is among the most crucial. To evaluate the viability and profitability of your insurance firm, lenders and investors will give your financial forecasts top priority. This part should contain:

- Projections of income for your company from investments, sales, and premiums will help you to determine.

- Analyze your startup’s and continuous expenses covering technology, marketing, staff pay, and overhead.

- Profit and Loss Declaration: Project thorough profit and loss for the first few years.

- A projection of your company’s cash inflows and outflows can help you to guarantee liquidity.

Also Learn More: exemple business plan assurance pdf

Strategy for Managing Risk

The insurance sector is naturally linked to risk management, hence this part describes how your company will manage the risks connected to your insurance products: claims, changes in the market, and regulatory problems. You should target:

- Kinds of risks (market, underwriting, operational)

- Policy terms, diversification, reinsurance—risk mitigating techniques

- Legal risks and regulatory compliance

Projections of Income for an Insurance Company

Any business plan starts with the financial prediction since it is fundamental. These forecasts act as a guide for future performance of your insurance company. Common forecasts call for balance sheets, cash flow statements, and income statements.

| Financial Document | Description |

|---|---|

| Income Statement | Shows the projected revenue, costs, and profits over a specific period. |

| Balance Sheet | Provides a snapshot of your business’s assets, liabilities, and equity at a given point in time. |

| Cash Flow Statement | Details the inflows and outflows of cash, ensuring that your business maintains sufficient liquidity. |

FAQs

How may my insurance company’s business model be successful?

A good company plan calls for careful operational and risk management strategy development, accurate financial estimates, and extensive market research. To make sure all important areas are addressed, use a tested template or see a qualified business planner.

Which are the main components of a plan of business for an insurance company?

The executive summary, firm description, market research and analysis, marketing strategy, operations plan, financial plan, and risk management strategy constitute the essential sections.

Should my company plan call for financial projections?

Indeed, proving the profitability and durability of your company depends on showing the financial forecasts. Lenders and investors will examine these forecasts very attentively.

Could I use a PDF business plan example?

Indeed, a PDF sample can be a useful tool for grasping the organization and ideas of a business plan. Templates are available online or you may download free samples.

How long ought my business plan to be?

Although the length is not set, depending on the complexity of your organization, a business plan for an insurance company should usually run 20 to 30 pages.

How best should I communicate my marketing plan?

Share your marketing plan by outlining your target market, main channels of marketing, methods of customer acquisition, and anticipated results. Add quantifiable goals including targets for revenue and customer increase.

Conclusion

Ensuring long-term profitability depends critically on an insurance company developing a business plan. With the correct strategy in place, you can boldly negotiate the regulated and competitive insurance market. Using the example business plan assurance PDF and applying the advice in this article will help you to start and expand a profitable insurance company. Emphasize your market research, financial forecasts, and risk-management techniques to produce a strong plan covering all facets of your company.